The Value of Youth

How many more life insurance ads have you seen with someone holding a baby than holding a diploma? Or having dinner with family versus drinks with friends? It’s not surprising. Most people don’t even think about life insurance until they have a child, but by then it might be too late to get the best price.

Older, wiser, and more expensive.

Over the years, the average age for couples having their first child has gone up. And with that increase in age comes an increase in insurance premiums. If you’re in your 20s or even your 30s, now is the time to consider purchasing life insurance. (You’re only going to get older.)

Steady premium, growing responsibility

If only we had a crystal ball, planning for our future would be so much easier. Just gaze into the ball and see what assets you’ll have in 20 years. What debts will you have? What will your family look like? Well, in lieu of a crystal ball we turn to research, history, and statistics. And what we’ve learned is that you’re likely to have more of everything. If you’re a single 20-something living in a rental, the chances of you buying a home down the road may be good. The chances of having kids, may be even greater.

Life insurance for the cost of cell phone insurance

Consider a modest policy of $100,000. If you’re a healthy woman under 30 this may cost you as little as $5/month. Yes, that’s just $60/year, which may be what you’re paying for cell phone insurance. Wait until you’re 40 and that price will triple to nearly $15/month, or $180/year. Even a $500,000 policy can be had for under $13/month – when you’re young and in excellent health.

And remember, unlike cell phone insurance, life insurance is not about protecting what you have, it’s about protecting those you care about.

No regrets

Life can be full of regrets – relationships, tattoos, that night in the desert… But when was the last time you heard anyone talk about regretting a basic life insurance policy? The fact is, for as little as $5 or $10 a month you can have peace of mind for the next 20 years. And let’s face it, the worst-case scenario is that you won’t get the chance to claim your benefits.

Open Enrollment: What are your options?

It’s a confusing time for health care coverage in this country, and things seem to change every day. Open Enrollment starts in November, but what is it, exactly? And who is it for? Here are some pointers so you can understand your options.

It’s a confusing time for health care coverage in this country, and things seem to change every day. Open Enrollment starts in November, but what is it, exactly? And who is it for? Here are some pointers so you can understand your options.

What is the ACA? The ACA is the Affordable Care Act. Some call it “ObamaCare.”

What is Open Enrollment? It’s the period during which individuals can sign up for health insurance on the open market, such as through a state exchange or HealthCare.gov. Shoppers can choose between different tiers of service and prescription coverage, and every applicant is guaranteed coverage, even if the enrollee has a preexisting condition. Each state has its own rules and regulations, so there are different options at different prices depending upon where one lives.

Who needs Open Enrollment? Open Enrollment is not relevant for those covered through an employer, but Open Enrollment is for the millions of people not covered at work.

Never had health insurance? You can sign up during the enrollment period.

Want to switch plans? This is your chance. If you already have insurance and don’t want to change, you don’t have to do anything.

When is Open Enrollment? This year, Open Enrollment is November 1 through December 15. At only 45 days, this is down from the three months it has been in recent years. Signing up during Open Enrollment period will provide coverage effective January 1, 2018. Experts predict that the smaller enrollment window could result in fewer “healthy procrastinators” signing up, and less switching to lower tier plans by those who are already insured.

What is a Special Enrollment Period?

If you have had a “qualifying life event” (or QLE) you do not have to wait until Open Enrollment to purchase health insurance. The full list of QLEs is here, and here are the four basic categories:

- Loss of health coverage: this could be losing coverage from a change in employment, or hitting 26 and no longer being covered under a parent’s plan

- Household change: marriage or divorce, adding a family member through birth or adoption, a death in the family

- Change in residence: moving to a different ZIP code or county (this can include students), moving to or from a shelter or other transitional housing

- Other qualifying events: change in your income that affects the coverage you qualify for, becoming a U.S. citizen, leaving jail or prison

Where? Look to healthcare.gov, your alumni insurance program, a health insurance specialist, or individual insurance companies for specific plans and prices.

What next? Be prepared for this year’s Open Enrollment or your Special Enrollment Period by noting the deadlines, your typical heath care usage, names of important doctors you’d like in your network, and by fine-tuning your budget and whether you prefer a higher deductible with lower premiums or a lower deductible with higher premiums. A little planning can go a long way.

More telling than your resume: Your digital profile

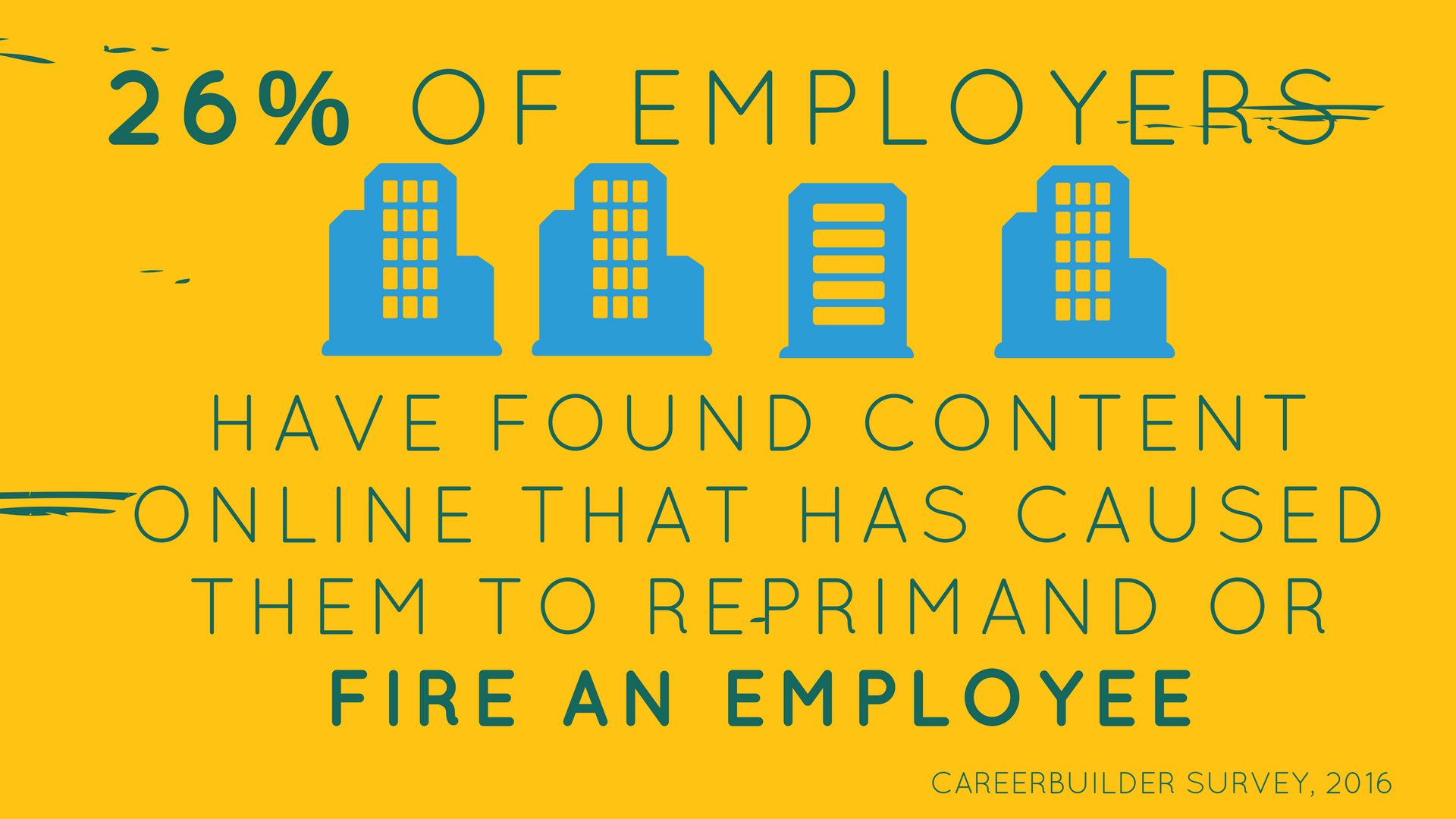

No doubt you’ve heard about the 10 Harvard students whose acceptances were rescinded after posting offensive memes in a “private” Facebook group. How about the Yale Dean who was fired for her Yelp reviews that were racist and derogatory? Each day we see people suffering new consequences because of their actions on the internet.

No doubt you’ve heard about the 10 Harvard students whose acceptances were rescinded after posting offensive memes in a “private” Facebook group. How about the Yale Dean who was fired for her Yelp reviews that were racist and derogatory? Each day we see people suffering new consequences because of their actions on the internet.

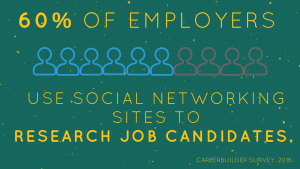

What does this mean for you? A lot, if you are job searching, or ever plan to be. Most employers routinely search online to see what they can find out about prospective employees.

Employers are even upfront about doing so…here’s a snippet from a Starbucks job application:

We also may collect information that is publicly available. For example, we may collect information you submit to a blog, a chat room, or a social network like Facebook, Twitter or LinkedIn. We may also collect information about you from other companies and organizations.[1]

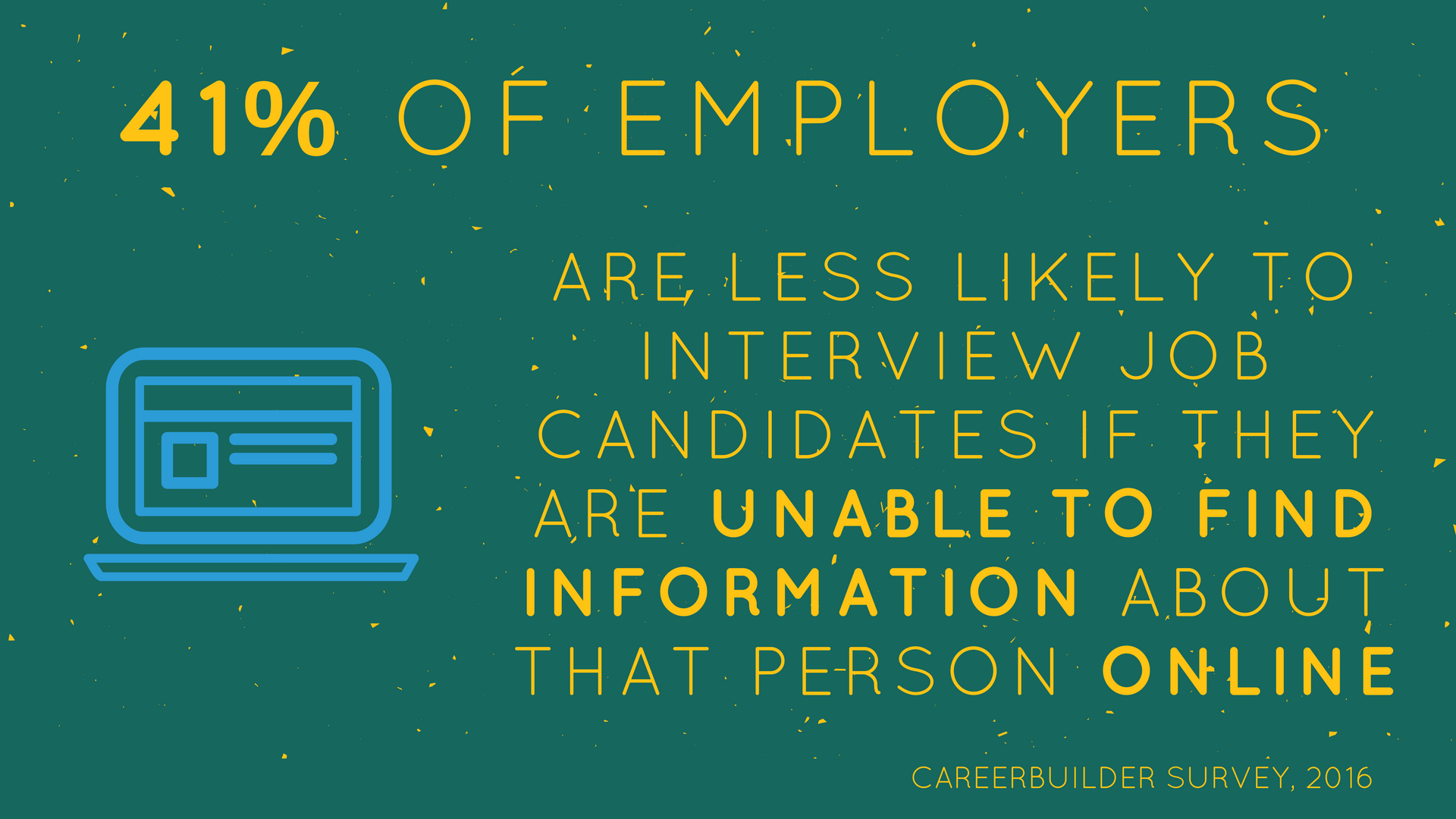

So, what can you do to make sure that potential employers see an online presence that helps your job search?

- Check out your online profile. Do a search to see what an employer will view when they look you up. And even if you’ve done it before, do it again to see if anything new pops up. Don’t only Google yourself – Bing yourself. And Yahoo, DuckDuckGO, ASK, Dogpile, and Quora yourself. Search your email address and your name with quotes around it.

- Even though it seems obvious, don’t write or post anything that you wouldn’t want to have broadcast in Times Square or have your parents read out loud at a family dinner. There’s really nothing private on the internet.

- Lock your stuff down, but not too tight. Make sure all of your accounts have the privacy settings turned on: Facebook, Instagram, LinkedIn, Twitter, etc. Don’t let just anyone be your friend or follow you, especially when you are job searching. But at the same time, don’t be completely invisible– you want to have some web presence. What shows up in a search for your name should reflect your work personality, not your party personality.

- If you don’t like what you see, take action. Buy your name as a domain and create a website. These typically come to the top in online searches, and you control exactly what’s on the site. Or, you can increase the SEO (search engine optimization) for your name by making sure that your real name is used on your Facebook profile and other sites; then run searches to move these “good” results up in the ratings. Another option is to outsource it: Brandyourself was started by a college graduate who was having a difficult time getting a job – until someone told him that when his name was Googled, a drug dealer with the same name showed up at the top of the search list. The former job seeker created an affordable service that only shows positive results for your name.

Though we can’t promise these tips will help you get a job, they can help you turn your digital profile into an asset.

Sources:

https://people.com/celebrity/employees-who-were-fired-because-of-social-media-posts/

https://cyberbullying.org/the-importance-of-your-digital-reputation

https://www.pewinternet.org/fact-sheet/social-media/

[1] https://www.starbucks.com/about-us/company-information/online-policies/job-seeker-privacy-statement

Help! Someone stole my suitcase!

Travel insurance often covers a few hundred dollars for lost luggage, but if your favorite suit and kicks are in there, a few hundy won’t help much. Homeowners or renters insurance often covers stolen possessions, but make sure you have “off premises coverage” or that stolen bag may be on you.

Homeowners and renters is typically subject to a deductible, so if you do have travel insurance to help with the first few hundred dollars, that may be the winning combination.

Doggone it! My dog bit someone!

Each year, 4.5 million people are bitten by dogs. Most homeowners and renters insurance have liability provisions to cover this sort of incident. Good thing because the average dog bite claim is over $30,000!

Oh boy! My son’s laptop was stolen the day he moved in to his dorm – and he doesn’t have insurance!

If you do, he’s covered. Homeowner’s or renter’s insurance will cover your child’s possessions if he/she is a full-time student under age 26 living on campus. That said, there’s a deductible to satisfy so if the laptop is pricey or if his phone, wallet, leather satchel, and fancy sneakers were swiped too, then filing a claim may be worthwhile, but if the value of the stolen goods doesn’t exceed the deducible, there may not be much of a claim.

Sources:

https://www.iii.org/issue-update/dog-bite-liability

https://www.foxbusiness.com/features/2013/03/20/five-home-insurance-benefits-away-from-home.html

https://www.bankrate.com/finance/insurance/things-your-home-insurance-covers.aspx

https://www.policygenius.com/blog/what-renters-insurance-covers-and-what-it-doesnt/

What happens to your student loan if something happens to you?

According to the Consumer Financial Protection Bureau, over 90% of student loans are co-signed. If you’re like millions of young Americans with co-signed student loans, consider what would happen to that debt if you died.

If you have federal loans, your debt will die with you. However, private loans don’t have the same consumer protection clauses – if something happens to you, it’s generally up to your co-signor to continue the payments. While lenders might be willing to work with your co-signor, they are under no obligation to reduce the balance or change the payment terms. If you are married, even if your spouse did not co-sign your loan, he or she could be held responsible for your debt.

Consider term life insurance if you think someone else would be responsible for paying your debt in your absence. Coverage is more affordable than you may think—a $50,000 policy costs a healthy 25-year old woman less than $5 a month.

Top 5 Reasons Why Millennials Should Consider Life Insurance

When you’re just starting out, investing in life insurance may seem like a waste of money, but there are some good reasons to buy it sooner rather than later.

- It’s inexpensive. Premiums are based on your age and overall health. As a young and healthy person, you are less of a liability to an insurance company, so you’ll pay less for coverage, especially if you don’t smoke.

- You’re not invincible. Although we don’t like to think about it, funerals are costly – between $7,000 and $10,000, on average. If something should happen to you, someone will have to foot the bill. A small life insurance policy can help.

- You have debt. Even if you don’t have student loans, other debts like credit card balances and mortgages can add up. If you’re a newlywed and you’ve accumulated credit card debt on a joint account or co-signed a lease, consider whether your spouse would be able to handle these obligations alone.

- Your employer’s insurance may not meet your needs. Even if you’re fortunate enough to land a job that offers an excellent benefits package, buying a separate life insurance policy can be a smart move. If you need more insurance, it may cheaper to buy a separate policy than to add coverage. And your own policy stays with you if you become unable to work or change jobs.

- It’s a nice way to leave a legacy. Are you passionate about a specific cause or charity? When you apply for life insurance, you can designate a charity or other non-profit organization as a beneficiary.

Life insurance can take care of all of these financial issues so your loved ones won’t have to bear a financial burden should the unthinkable happen.